You are here:

Anonymous

Joined Anonymous

Posts Anonymous

|

Bridging lending bounces back after lockdown

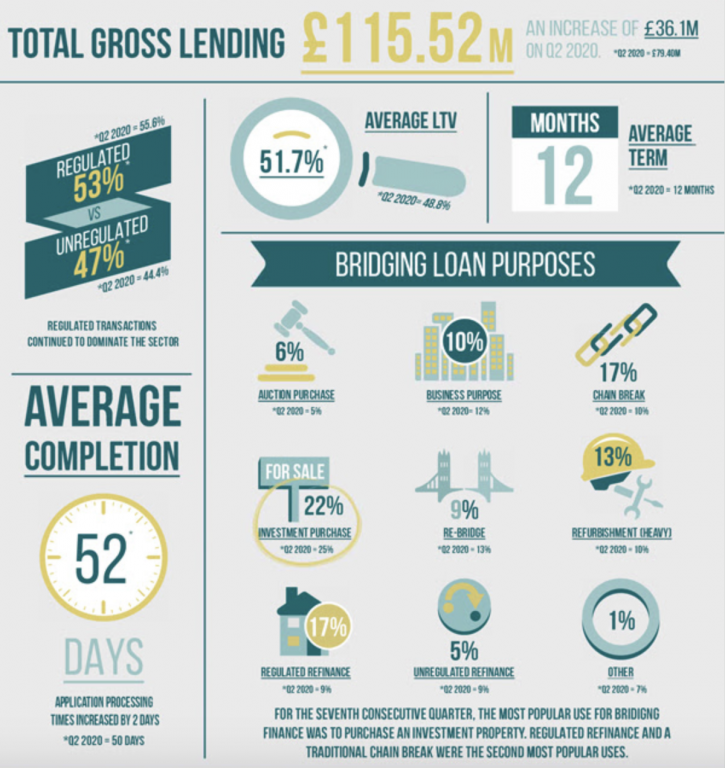

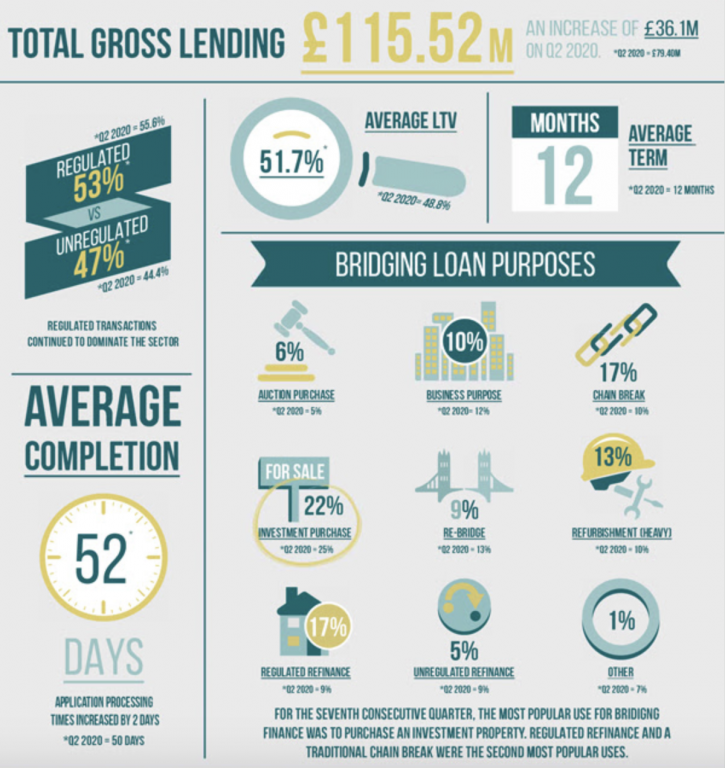

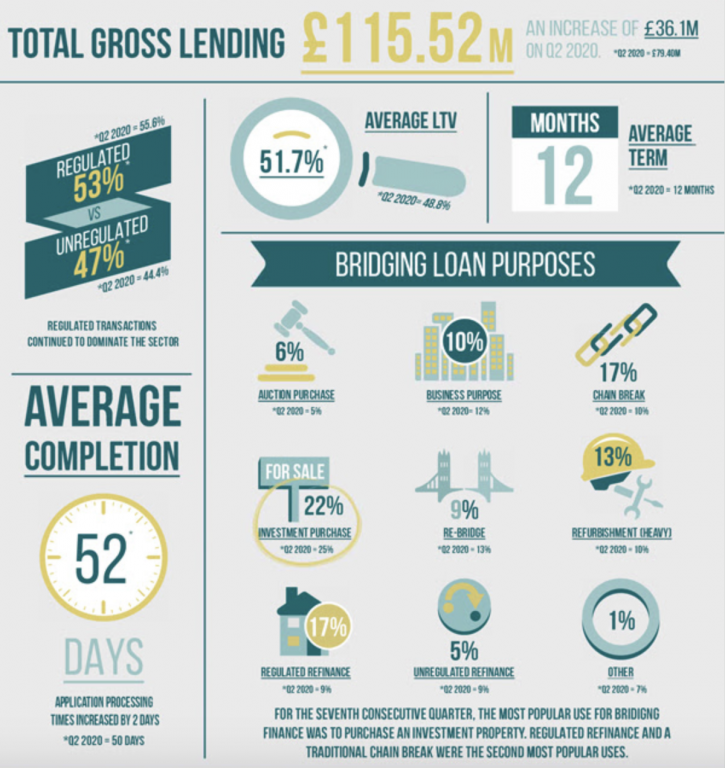

Bridging Trends reports a 46% rise in gross bridging loan volumes in Q3 2020, as activity recovers from the Covid-19 lockdown.

Key points

- 46% rise in bridging loan volumes in Q3

- Regulated transactions continue to dominate the sector

- Average interest rate falls in line with pre-Covid-19 levels

- Increase in demand for regulated refinance

Contributor lending transactions totalled £115.52 million in the third quarter of 2020 and although lending figures were 36% below the pre-Covid-19 levels of £180.94 million, they had risen significantly (46%) from the £79.4 million of bridging loans transacted in the previous quarter.

Regulated bridging lending continued to dominate at an average of 53% of all lending, compared to 47% of unregulated transactions.

The average weighted monthly interest rate in Q3 decreased to 0.78%, from 0.85% in Q2.

Both regulated refinance and traditional chain break were the second most popular uses for bridging finance, contributing to 17% of all lending in Q3. Demand for regulated refinance increased by 8% and chain break by 7%.

Gareth Lewis, commercial director at MT Finance, comments:

“The stamp duty holiday and rising house prices has ensured that the market remains busy and it has been well publicised that the mortgage market is currently feeling the strain when it comes to delivering acceptable processing turnaround times, which can add to an already stressful experience. Luckily, bridging finance is a useful tool for brokers to help unlock a transaction for a client allowing them to meet deadlines.

“Given the stress on a chain, presented by the slow processing times, it is unsurprising to see more clients turning to regulated bridging finance to support their purchases.”

|

|

|

Why use impact for Bridging?

- We can immediately identify lenders who can assist with specific circumstances - bridging is not one size fits all

- We have access to bridging lenders who operate on a limited distribution basis

- We have Lenders on-site to support us

- We can deal with the day to day processing of the application giving you more time to generate further new business

- You may receive a higher procuration fee then if you went directly to the lender

|

|

|

|

Make the right impact, speak to the team today on 01403 272625.

|

|