|

It’s difficult to put a number on missed opportunities to sell insurance products but if you have spent money generating leads – on average at least £10 per lead according to some industry commentators, it’s wasted spend if you cannot follow up quickly enough.

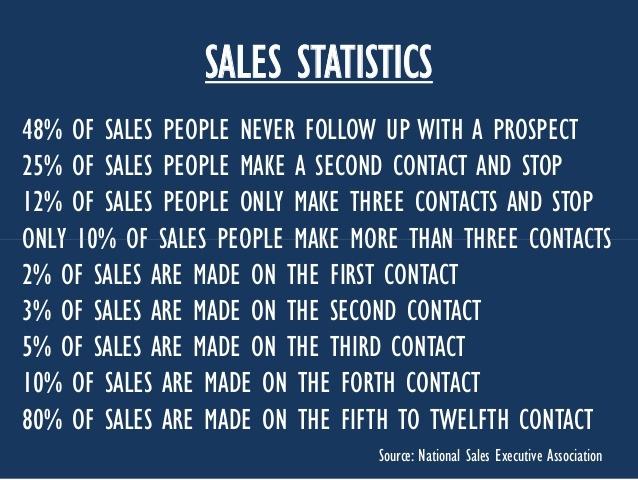

In today’s digital world where consumers expect to get an immediate response at the click of a mouse and have the ability to shop around from the comfort of their own sofa at any time, day or night, an effective response mechanism is a must. Failure to respond quickly enough to customer enquiries whether generated by an aggregator site or not could result in the customer taking their business elsewhere.

However, unlike their general insurance broking cousins, mortgage intermediaries are facing the harsh realities of selling under the new MMR regime. The whole process is taking longer – up to a couple of hours – putting a strain on resources with the result that the general insurance sale could be delayed or even lost.

One simple solution is to refer customers to general insurance providers such as The Source, and leave us to manage the insurance sales process. Our referral service is available online 24 hours a day, 7 days a week. You simply enter the customer’s name, some basic information about them and the insurance product they are looking to buy, and when to contact them and our dedicated team will do the rest. You’ll not only earn commission on the cases that we sell on your behalf, but trail commission on future renewals for as long as the policy is live – even if you retire or leave the industry.

In a demanding world where time is precious, referral services makes sense and allows you the opportunity to put those three magic minutes to good use developing your core business.

Source

|