Report topic or post

If you feel like the content shown below has broken cherry's rules, please click the "Report to cherry" button at the bottom to let us know why.

Like many lenders, we’re currently experiencing a surge in interest from landlords who are looking to diversify their portfolios. This forms part of a wider picture where landlord demand remains strong, and sustained, right across the buy to let sector.

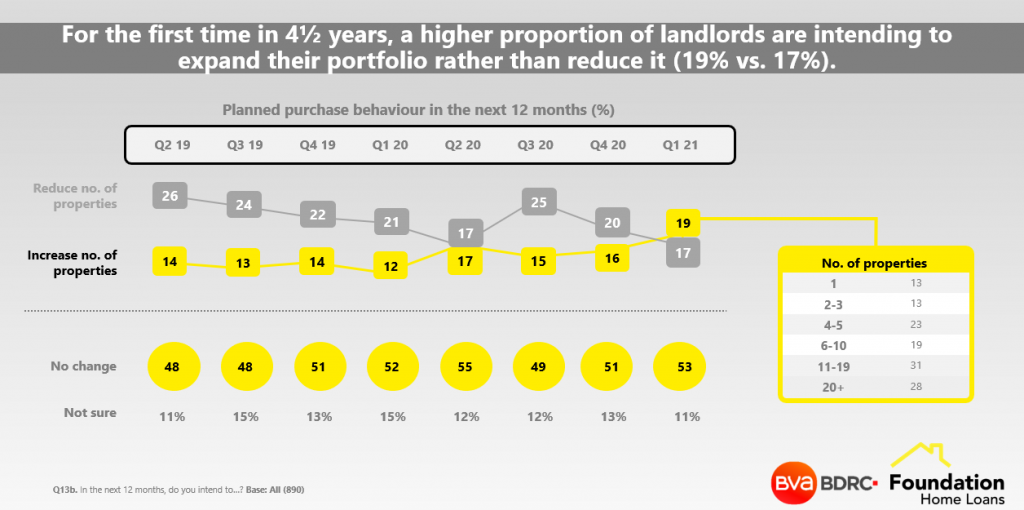

One of the main headlines from our recent quarterly Landlord Panel research in conjunction with BVA BDRC of 895 landlords was that for the first time in four and a half years, a higher proportion of landlords are intending to expand their portfolio rather than reduce it (19% vs. 17%).

Within this, landlords with 11-19 properties were said to be the most likely to be looking to grow in the next year, following a 9%pts increase versus the Q4 ’20 data.

In addition, landlords operating in the North East and Wales were highlighted as ‘most likely’ to be active in the BTL property market in the next year, with around half looking to either buy or sell.

Unsurprisingly, the landlords look to maximise profits where possible, by increasing the income side with higher yielding properties, and reducing expenditure with lower cost mortgage solutions, which is why we recently introduced some fee-assisted options for BTL purchases as well as remortgages.

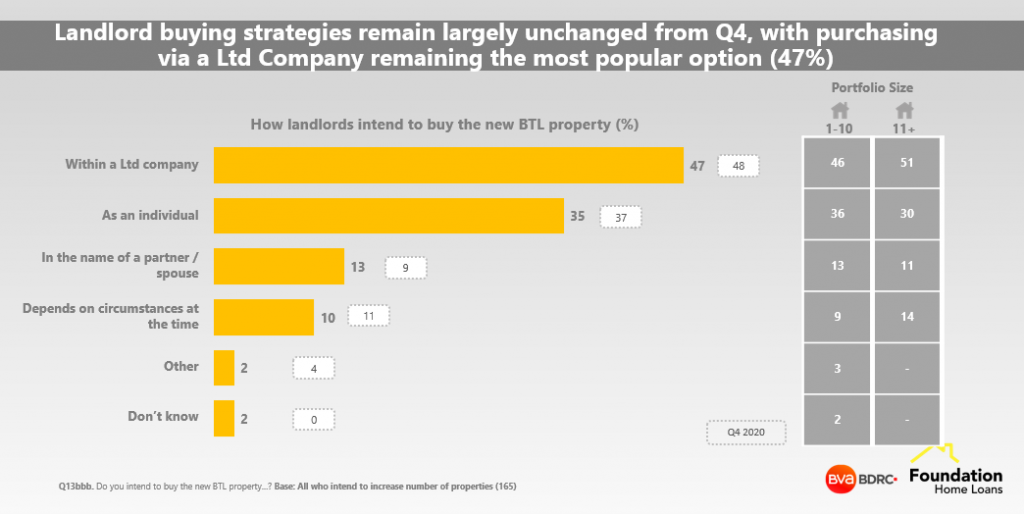

Whilst the majority of landlords rent their property as an individual (80%), 18% of landlords currently hold at least one of their properties within a limited company structure but of those Landlords intending to buy this year, 47% reported that they intend to buy their next property via a limited company, a sentiment largely unchanged from Q4 2020, and which we expect to continue to be on of the fastest growing areas of advice requirement in the coming years.

Purchasing strategies remain relatively similar regardless of portfolio size, with 11+ property landlords only slightly more likely than their smaller counterparts to intend to buy within a Ltd company structure (51% vs. 46%).

If you’re a mortgage intermediary, and you’d like to continue to be among the first to receive the latest data on landlord intentions and buy to let market trends, click here to register.