Report topic or post

If you feel like the content shown below has broken cherry's rules, please click the "Report to cherry" button at the bottom to let us know why.

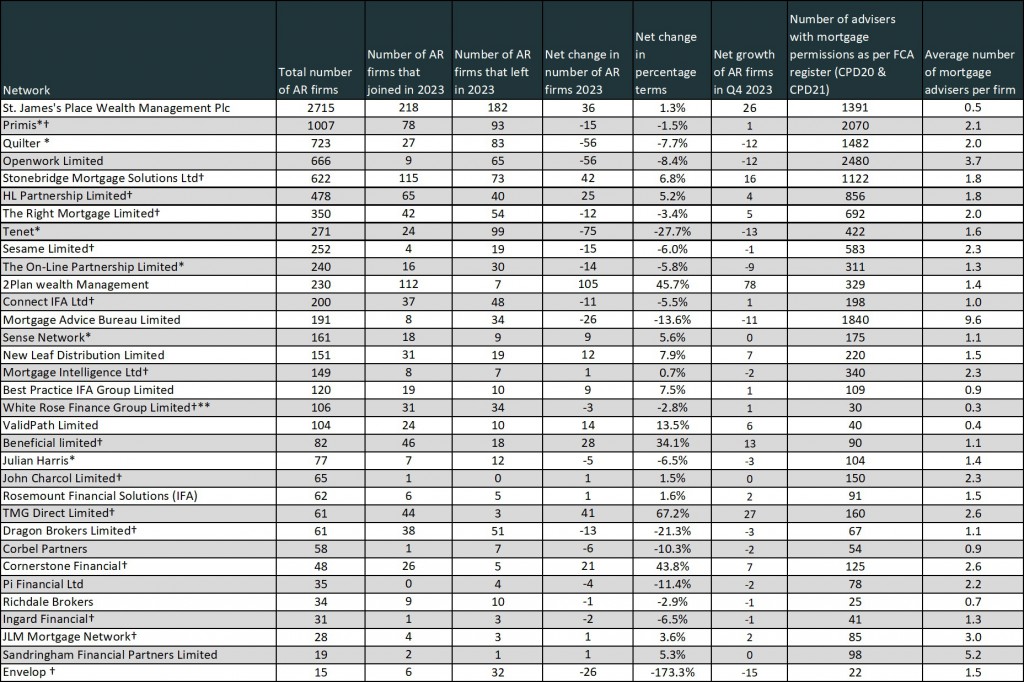

110 NET GROWTH IN FIRMS JOINING NETWORKS IN Q4

* denotes multiple principals (networks) trading under one network brand

† denotes networks holding only mortgage and protection permissions

** specialise in consumer credit

Source: FCA register

Figures correct at 5th January 2024

The network league table illustrates Appointed Representative (AR) firm movements for the 2023, Q4 differential and current mortgage adviser numbers.

Encouragingly, the net growth in AR firms for Q4 2023 increased by 110 across the main networks that are prevalent in mortgages. In 2023, the total number of AR firms leaving networks verses those that joined, illustrates stability, with 1070 leaving, compared to 1077 joining. This would suggest that Q4 experienced an influx of new firms joining networks, rather than just moving from one to another.

When we produced these figures for Q1 2023, there was 99 more firms leaving than joining networks, so what can we draw from the Q4 uplift? Perhaps there is a transition of some firms from Direct Authorisation (DA) to AR status, or that there are advisers leaving larger practices joining a network and setting up their own AR firm. Regardless of the reason, it has to be seen as a positive statistic which will hopefully develop in to a trend throughout 2024.

The network league table is produced to monitor the movement of AR firms and should not be used as metric by which choose a network. With that said, looking at those with the largest growth, 2Plan stand out in 2023 with an annual net growth of 105 new AR firms, complimented by an impressive increase of 78 new firms net in final quarter of the year.

The biggest talking point in 2023 across networks, was obviously the announcement by Tenet Group (experiencing a net loss of 305 AR firms since the end of 2018) of the sale of its network brands, TenetConnect, TenetConnect Services, primarily wealth networks and TenetLime, their dedicated mortgage network. The wealth firms being sold to Openwork and 2Plan, while TenetLime is being sold to Primis. So, one could be excused of thinking that 2Plan’s AR growth in 2023 may be a result of the Tenet sale, however, only 18 of the 78 they appointed in Q4 came from Tenet.

Given the imminent conclusion of the Tenet sale, surprisingly, the FCA register shows that Tenet appointed 24 firms in 2023, 21 in Q4. However, these firms have just been dual authorised, moving from other Tenet brands to TenetLime. This is likely to be firms that only deal in mortgages & protection and being moved in preparation of the transition from TenetLime to Primis. It is important to note that the table takes account of any dual authorisations by removing them, only counting each firm once.

It's possible that there may be further consolidation, in fact some commentators believe it to be inevitable. Conversely there is talk of growth and even emergence of new smaller networks, giving financial advisory professionals choice, which would surely be a good thing.

Giving foundation to the those that believe smaller networks will benefit from growth, in 2023, both TMG and Cornerstone experienced 67.2% and 43.8% net increase respectively. Other networks enjoying growth were Stonebridge, HLP and Beneficial, while there was a sizable loss in AR numbers for Envelop network.

Future tables will only include networks that have 20 or more AR firms, therefore Sandringham and Envelop will not appear.

more details on www.network-consulting.co.uk