Smart Currency

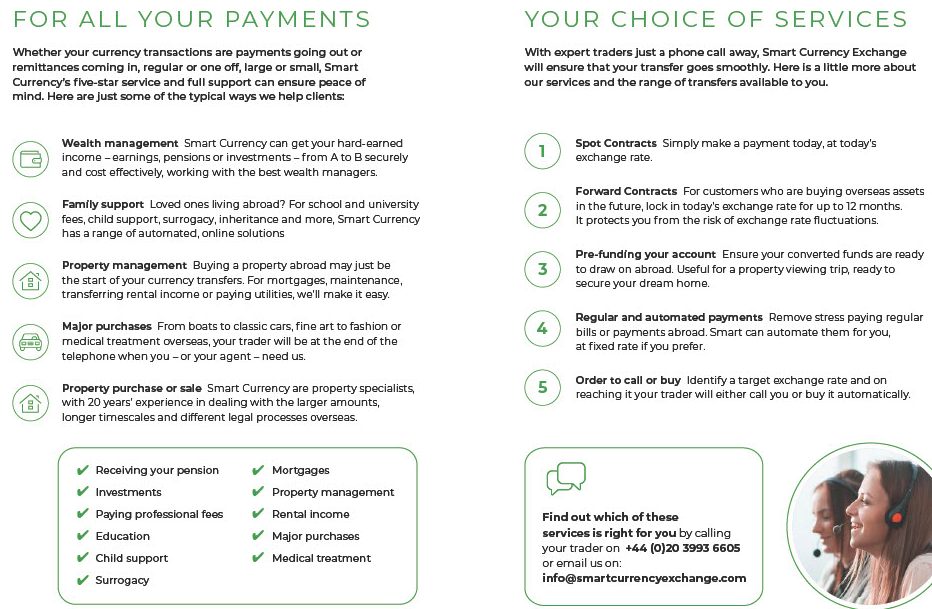

For any clients involved with:

- Overseas property purchase/sale.

- Purchase/sale of foreign shares.

- Sending money to family abroad.

- Beneficiaries of a foreign estate.

Don't leave your clients exposed to fluctuating currency exchange rates which could potentially derail their plans.

A relationship with Smart Currency can help you to add value for your clients and your business by:

- Connecting your clients with a trusted expert who can talk-through their situation over the phone

- Developing understanding of client wealth risk

- Ringfencing clients

- Earning commission (roughly £300-450 for every £100K transferred)

To get in touch about a partnership or a specific client, please email jack.rusted@smartcurrencyexchange.com or give me a call on 02038673266

Send to a friend

Send to a friend