Report topic or post

If you feel like the content shown below has broken cherry's rules, please click the "Report to cherry" button at the bottom to let us know why.

Great news, we’ve improved Clydesdale Bank's interest only policy. Live now.

We’ve expanded our LTVs, and given our affordability assessment a refresh to help us say yes to more of your clients.

Larger LTVs

We’ve increased our maximum LTV for part C&I, part IO to 85% LTV, for loans up to £1.5m.

- Up to 75% LTV can be taken on an interest-only basis.

- Any extra borrowing up to 85% LTV is taken on C&I.

- That’s the same for all the repayment vehicles we accept.

We’ve also ditched the 70% LTV restriction we had for downsizing on loans above £1.5m, so downsizing can now be used up to 75% LTV on an interest-only basis. Any borrowing above 75% LTV must be taken on C&I.

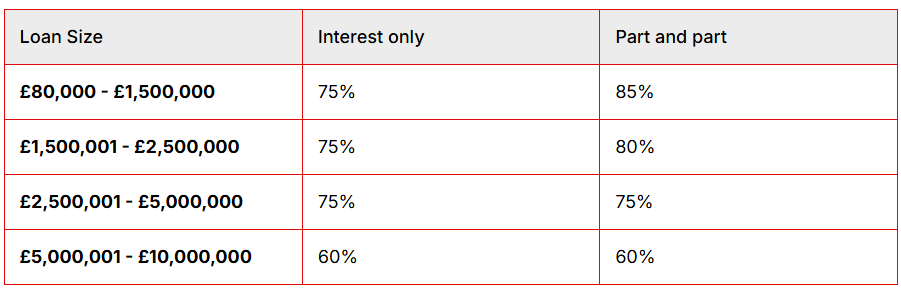

Here’s our new maximum LTVs for interest only and part & part:

Revamped affordability

We’ve updated our affordability assessment for interest only and part & part loans.

Instead of calculating affordability as if the loan were capital and interest, we now use the actual repayment type, so we could lend your clients more.

It’s live in our affordability calculator, so why not give it a try.

Other changes

- We no longer allow debt consolidation on interest only, unless it was used for property improvement or repair. Instead, debt consolidation needs to be on a capital and interest part of the loan.

- We’ve clarified that if we’re lending on a second home, we don’t require a minimum amount of equity, like we do when a client is downsizing from their main residence.

- We’ve tweaked some of our policy when using sale of another property, cash savings, or investments as a repayment vehicle.

For full details check out our lending criteria.

Any questions?

If you’ve got questions, you can get in touch with your Business Development Manager.

The team at Clydesdale Bank