Fleet Mortgages launch 1st Quarterly BTL Index with Rental Barometer

07 February 2020

Fleet Mortgages, the buy-to-let specialist lender, has today (7th February 2020) launched the first iteration of its new Quarterly Buy-to-Let Index, which features a Rental Barometer analysing rental yields across all regions of England & Wales.

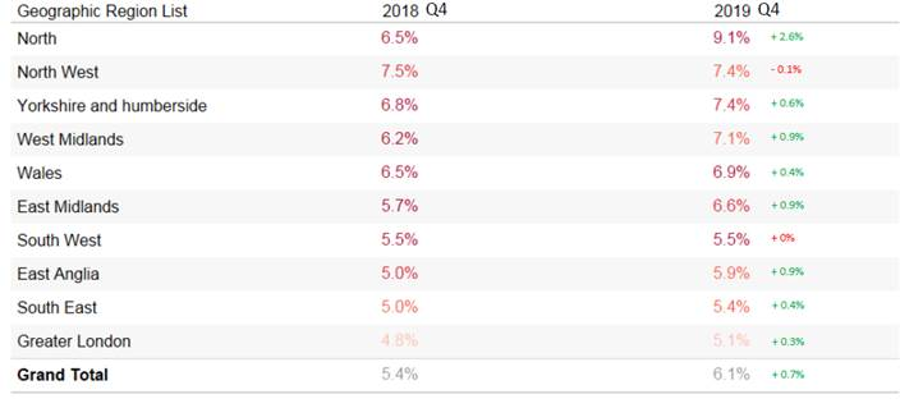

The regional snapshot covers all the areas in which Fleet lends and highlights the rental yield changes that have occurred in each region. In this iteration of the Index, the comparison is between Q4 2019 and Q4 2018.

Overall, the Index shows rental growth of 6.1% across England & Wales, up 0.7% on the 5.4% growth achieved in the last quarter of 2018. The North of England posts the top rental yield regional figure for the quarter, up 2.6% year-on-year to 9.1%; Fleet’s figures for 2019 as a whole show rental yields for Northern (comprised of the North, North West, and Yorkshire & Humberside) properties reached 7.6%.

Only one region – the North West – showed a slight drop in rental yield over the period; down to 7.4% from 7.5%, while yield figures for the South West remained unchanged.

Greater London posted the lowest rental yield figure of 5.1%, however this was still an increase of 0.3% from Q4 2018 figures. Fleet highlighted the Greater London region as one of particular interest, especially when set against the regular data issued by the Office of National Statistics (ONS) in its Index of Private House Rental Prices.

In its yearly data - covering November 2018-2019 – ONS said London had the second lowest rental price inflation in England, at 1%, which put it only ahead of the North East. This lower rental inflation than the collective average of all other regions, suggests that supply outstrips demand in London relative to England as a whole.

Fleet’s data also shows that the large majority of mortgages sold in Greater London are concentrated in North London accounting for around 70% of mortgage applications in the region. However, average rental yields do not fluctuate much between the North and South of London, with the North at 4.6% and the South at 4.5%.

Fleet Mortgages said these latest figures were indicative of a number of trends within the private rental sector and buy-to-let market, notably:

- Supply – there are fewer rental properties available to rent with demand from prospective tenants outweighing supply.

- Type of residential property available – the need for greater yield to cover increased costs means many landlords are changing their single-tenancy properties to multi-tenancy. Fleet has seen an increase in HMO and multi-unit blocks within landlord portfolios.

- Regional purchases – more landlords are now willing to look beyond their own geographical locale when purchasing; those regions which can deliver greater yield are seeing an increase in landlord purchase interest.

Steve Cox, Distribution Director of Fleet Mortgages, commented:

“As can be seen by the first iteration of the Fleet Mortgages Quarterly BTL Index, despite political and economic uncertainty leading up to the General Election in December last year, we observed overall rental growth throughout England & Wales in Q4 2019, with only two regions showing either a very small drop or no change at all.

“In this context, it is perhaps not surprising to see those regions further North in the country posting the largest increases and outstripping the gains seen by properties in the South. On average, for 2019, for the North as a whole this was 7.6%, compared to 4.9% in Greater London and 5.2% in the South East, although the last quarter’s figures for both those regions show an improvement.

“Clearly, the market has shifted over the past 18-24 months as landlords get to grips with the increased costs that come with PRS activity, in particular the phased-in changes to mortgage interest tax relief for individual landlords, which will be down to a basic-rate level in April 2020. That has clearly impacted profitability for certain landlords and so a different approach has been needed and pursued.

“Landlords now tend to look differently at their properties, with many converting single-tenancy properties into multi-tenant ones in order to secure better yields. These higher yields are needed in order meet those growing tax liabilities, but to also offset the increased cost of acquiring tenants and regulation. Examples of these changes include more properties being converted into self-contained flats rather than keeping the property as a larger family home.

“Coupled with a much greater inclination to purchase further afield - in those very regions showing greater rental yield increases - we can see why certain regions continue to outperform others. However, with an overall squeeze on supply, coupled with a continued demand for quality properties by tenants, our view is that we are likely to see continued rental increases across the vast majority of regions, if not all, during 2020.

“In that sense, property investment will remain increasingly popular, and we fully anticipate that all types of landlords will seek to add to portfolios over the course of the next 12 months. It means that demand for specialist buy-to-let advice will remain high and advisers active in the sector should be able to secure strong client levels, particularly those seeking to utilise limited company vehicles, purchase and refinance HMO/MUBs, and develop and grow their portfolios.”

Fleet Mortgages’ product guide and full list of lending criteria is available to view by visiting its new website at: www.fleetmortgages.co.uk