MCI Club offers free Digital Mortgage Broker

20 February 2020

The MCI Club has today launched a new digital mortgage broker platform. Aimed at traditional brokers, it will be free to use for all existing members of the MCI Mortgage Club as well as new registrants, going forwards it will form an integral part of the Club’s proposition.

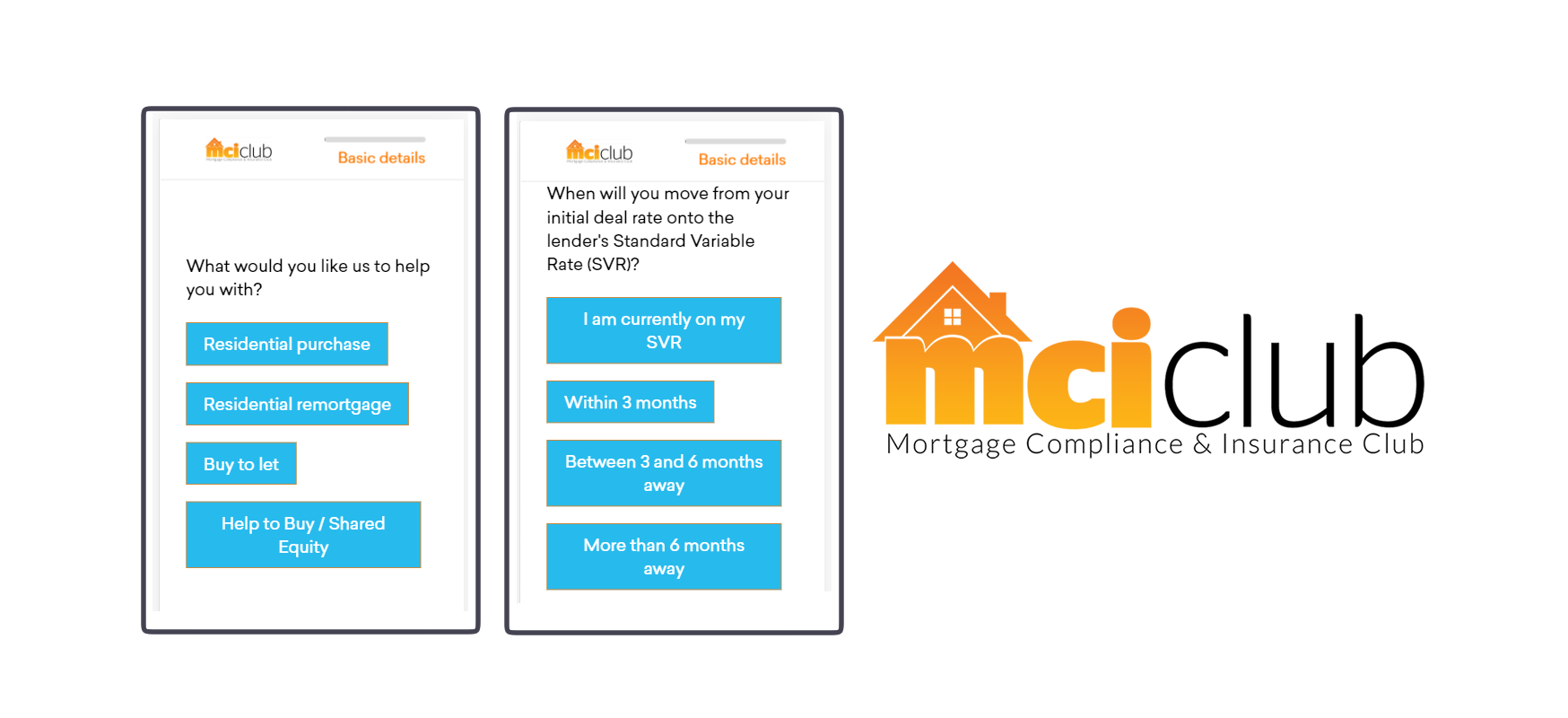

Using the same platform used by the online broker Burrow, previously known as Dwell, the immersive, interactive chat adviser will supplement a broker’s online activities. It will do this by helping brokers attract new clients digitally, it will then help them to digitally on-board and qualify new and existing clients.

The client will gain access to the platform via a link on the broker’s website or even via an email from the broker. It will be completely branded for each broker’s business so the client will feel like they are still dealing with the broker directly.

The platform intelligently gathers information from the client, including personal and employment details, type and size of mortgage required. It then uses a combination of product, criteria and affordability sourcing to deliver a mortgage report to the client as well as generating a more valuable lead back to the adviser who can then deal with the client remotely or face-to-face.

Phil Whitehouse, head of the MCI Club, commented that, “The Burrow platform is a fantastic enhancement to any UK intermediary business. It supplements any broker’s usual proposition, providing them with an online presence to compete with the Habitos and Trussles of this world, that have dominated the headlines in recent years.

“It levels the playing field for each and every intermediary business, by providing a digital broker platform that reflects and compliments each broker’s business uniquely. Leads can be integrated into any back-office system and the white-labelling options ensures there is no “bump” when moving from an intermediary’s website to the digital broker. Dealing with clients that have been through this process on line will save brokers a huge amount of time as the basic data gathering and qualification will have been completed already.”

MCI’s parent company, The eKeeper Group, has developed the Burrow platform for the intermediary sector; it has trialled the system for six months and observed extremely positive results.

David Bennett, eKeeper’s commercial director, confirmed that, “The Burrow platform eliminates the online challenges facing all UK mortgage brokers. More and more we see online engagement dominating in terms of capturing and retaining clients. By enabling intermediaries to have their own digital mortgage broker and integrate that into their existing processes and systems, every UK intermediary can have the best of both worlds”.

Whitehouse concluded, “MCI Club is fast becoming the mortgage club to support its members, through best of breed technology and products that help defend a broker online in an advancing and fast-paced environment.”