Loans Warehouse predicts 100% growth in Second Charge Lending in Q4

19 October 2020

Leading second charge brokerage Loans Warehouse is predicting a 100% growth in second charge lending in the final quarter of 2020.

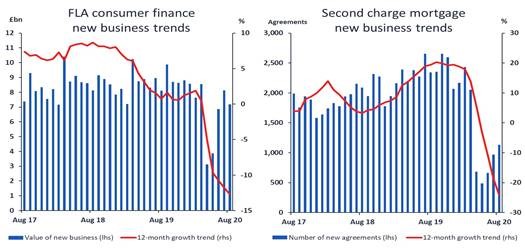

In February, prior to the COVID-19 pandemic, Second Charge lending stood at a total of £107m. However, this figure had declined 81% by May to just £21m.

Since then the market has recovered somewhat with lending having more than doubled by August to £43m.

This has led Loans Warehouse to make the bold prediction that these figures will double again by years end.

Matt Tristram, Co-Founder of Loans Warehouse, said: “Despite the pandemic we have traded throughout the year and it is our opinion the opportunity in Second Charge lending has never been better than it is today.

“I’m confident that August’s results be at least doubled again before the end of year. Despite a rocky few months for the Second Charge sector positivity has once again returned.”

Tristram’s comments come on the back of record mortgage lending during 2020. However, the market has been plagued with product restrictions at higher LTV levels and long delays.

But Tristram predicts that increased demand will also see many borrowers turn to Second Charge products in the months ahead to raise funds for the home improvement boom and debt consolidation.

The rapid recovery of the Second Charge market and recent increase in lending has been led by prominent lenders like Optimum Credit, United Trust Bank & Oplo (formerly 1st Stop Home Loans).

United Trust Bank (UTB) and Oplo especially have taken a much bigger market share than pre-pandemic. At the start of the crisis UTB stood out for many, delivering a series of well publicised summer ‘support packages’.

As such they could boast being the industry’s biggest lender in the market at one stage. A position believed to have been snatched away from them by Oplo.

Following a recent rebrand and its ability to maintain stable proposition throughout this year it is believed that Oplo grew to encompass over 20% of the second charge lending market in August.

Looking ahead the next few months looks set to see the return to the top of a more familiar champion; Optimum Credit.

The firm recently announced a £277m securitisation which has allowed the lender to lift the majority of the restrictions that had been in place since March, reduce rates across their Prime, Near Prime & XLTV range and it’s likely that September figures will show them back as market leader.

United Trust Bank has also continued with the release of several product enhancements last week including an increase in the maximum LTV back to 80%, a change also made a week earlier by Equifinance to their core plan.

Tristram added: “Competition between leading lenders will be the key driver which will see the Second Charge market double from the figures recorded in August before the end of the year.

“I expect to see September’s figures show a rise in lending to around £50m with October and November breaking the £80m barrier with ease.

Attached FLA figures for 2020

|

|