Brokers don’t back plans for looser limits on mortgage lending – Landbay

08 August 2025

- Intermediaries don’t favour proposals for banks to take more risks

Fewer than a quarter of mortgage brokers back plans for looser limits on mortgage lending, according to research undertaken by Landbay.

In a poll of brokers, the buy-to-let (BTL) lender found that only 23 per cent think Chancellor Rachel Reeves is right to be rolling back post-financial crash red tape.

At her Mansion House speech to City of London grandees in July, Rachel Reeves set out a vision for Britain’s financial services industry based on a regulatory system geared towards growth rather than eliminating risk.

She plans to lift limits on mortgages, “simplifying responsible lending and advice rules for mortgages, supporting home ownership and opening a discussion on the balance between access to lending and levels of defaults”.

The Labour government is trying to bolster growth after the economy flatlined in the second half of last year. The Treasury has been at the heart of the government’s effort to push regulators to come up with growth-enhancing measures.

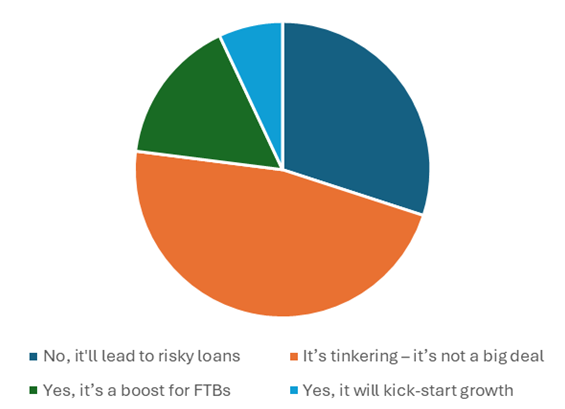

While roughly one in every six (16 per cent) of brokers told Landbay that the reforms would represent a boost for first-time buyers, only one in 14 (7 per cent) thought the reforms would kick-start growth.

“My greatest concern is we are regulated for risk whilst ignoring growth,” Reeves has said. “We need to make sure regulators are also taking into account the impact of their policies on growth — that is what we are determined to do as a reforming government.”

Three in every ten (30 per cent) of the brokers that Landbay polled thought the reforms proposed by Reeves would lead to riskier loans.

And almost half (47 per cent) said the chancellor was merely “tinkering” with mortgage rules and that “it’s not a big deal”.

Rob Stanton, sales and distribution director at Landbay, said:

‘The chancellor says she plans to tear up “reams of financial red tape” and be “ruthless in slashing rules that make the UK uncompetitive”. But brokers aren’t quite so sure that looser mortgage lending rules will deliver that. While Rachel Reeves’ ambition is clear, our research shows brokers are cautious. Only a quarter of the brokers we polled support rolling back post-crisis regulations, with nearly half dismissing the changes as mere tinkering. At Landbay, we understand the need for growth, but striking the right balance between access to lending and managing risk is critical to avoid repeating past mistakes.”

CHART 1: Is Rachel Reeves right to be rolling back post-financial crash red tape?

UK mortgage lending is controlled by a mixture of rules from the FCA and the Bank of England, most of which were introduced after the 2008 financial crisis, when several banks had to be bailed out by the state. The rules restrict how much banks can lend as a multiple of a person’s income or the value of a property and require affordability tests to check if borrowers can cope with future interest rate rises.

Rob Stanton said: “Our survey shows that brokers are sceptical about the reforms to mortgage lending rules, with just 7 per cent believing they’ll spark meaningful economic growth. This research reveals a clear concern among intermediaries, with 30 per cent warning the reforms will lead to riskier lending. At Landbay, we’re committed to supporting a stable and sustainable buy-to-let market, but these changes need careful consideration to ensure they don’t compromise long-term financial stability. Rather than relying on the cutting of red tape we’re exploring opportunities to ensure our range is competitive, while harnessing innovation through product transfers to increase routes for landlords set to refinance. Regardless of the regulation vs growth agenda, Landbay is pushing ahead to improve our range, equip brokers, and support borrowers.”

Landbay conducted their research in July 2025.