Halifax House Price Index - August 2025

05 September 2025

House prices continue to rise at a steady pace

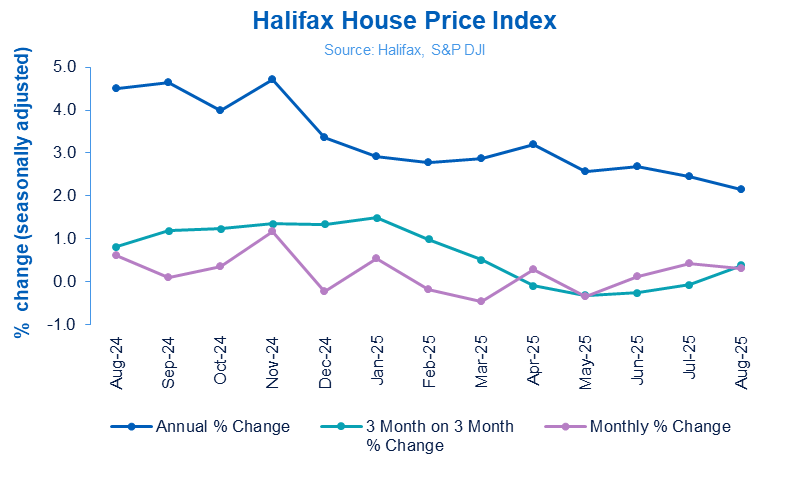

- House prices increased by +0.3% in August, marking a third consecutive monthly rise

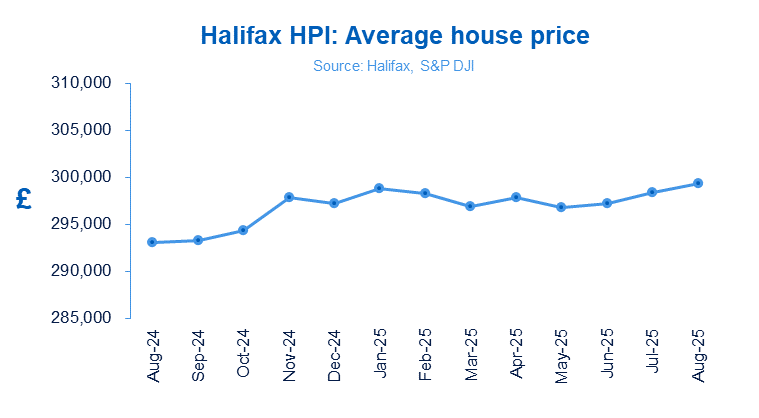

- Average property price now £299,331, edging up to a new record high

- Annual rate of growth eases slightly to +2.2% (down from +2.5% in July)

- Average price paid by first-time buyers falls slightly as affordability improves

- Northern Ireland continues to record the UK’s strongest annual house price growth

- England shows a North/South divide, with North East recording the fastest pace of growth

Amanda Bryden, Head of Mortgages, Halifax, said:

“UK house prices rose again in August, up by +0.3% (£932), marking the third consecutive monthly increase. The average property price now stands at £299,331 – a new record high – although annual growth has eased slightly to +2.2%.

“The story of the housing market in 2025 has been one of stability. Since January, prices have risen by less than £600, underlining how steady the market has been despite wider economic pressures.

“Affordability remains a challenge, but there are signs of improvement. Interest rates have been on a gradual downward path for nearly two years, and many of the most competitive fixed-rate mortgage deals now offer rates below 4%.

“Combined with strong wage growth – which has outpaced house price inflation for nearly three years – this is giving more prospective buyers the confidence to take the next step. Summer is typically a quieter period for the market, so the recent rise in mortgage approvals to a six-month high is an encouraging sign of underlying demand.

“While the wider economic picture remains uncertain, the housing market has shown over recent years that it can take these challenges in its stride. Supported by improving affordability and resilient demand, we expect to see a slow but steady climb in property prices through the rest of this year.”

First-time buyer affordability improves

“Though overall prices have edged higher, average property values for first-time buyers moved in the opposite direction over the summer, a trend that will be welcomed by those looking to get on the ladder.

“For those able to overcome the hurdle of saving a deposit, the numbers increasingly stack up. The typical first-time buyer property now costs £237,577, down -0.6% since May. On a 95% LTV mortgage over 30 years, that could mean monthly repayments of around £1,179 compared to the average UK private rent of £1,343.”

Nations and regions house prices

Northern Ireland continues to lead the UK for annual house price growth, with average property values up +8.1% over the past year. However, this marks a slowdown from +9.3% last month. The typical home now costs £217,082.

Scotland saw the next strongest annual increase with prices rising +4.9% in August to an average of £215,594.

In Wales, property values rose +1.6% year-on-year, though the pace of growth has eased in recent months. The average home now costs £227,786.

Across England, there remains a clear North/South divide. The North East, North West, and Yorkshire & the Humber all recorded annual growth above +4%, making them the fastest-rising regions.

By contrast, the South West saw prices fall -0.8% over the past year, the first UK nation or region to record an annual decline since Eastern England in July 2024 (-0.2%).

London continues to see modest growth, with prices up +0.8% year-on-year. It remains the most expensive part of the UK, with an average property value of £541,615.

PLEASE SEE ATTACHED RELEASE FOR FULL NATIONAL AND REGIONAL DATA TABLES