Halifax increases access to homeownership for non-UK nationals

13 November 2025

Halifax has announced changes to lending criteria for non-UK nationals from 14th November that will help more customers looking to buy a permanent home in the UK.

What’s changing?

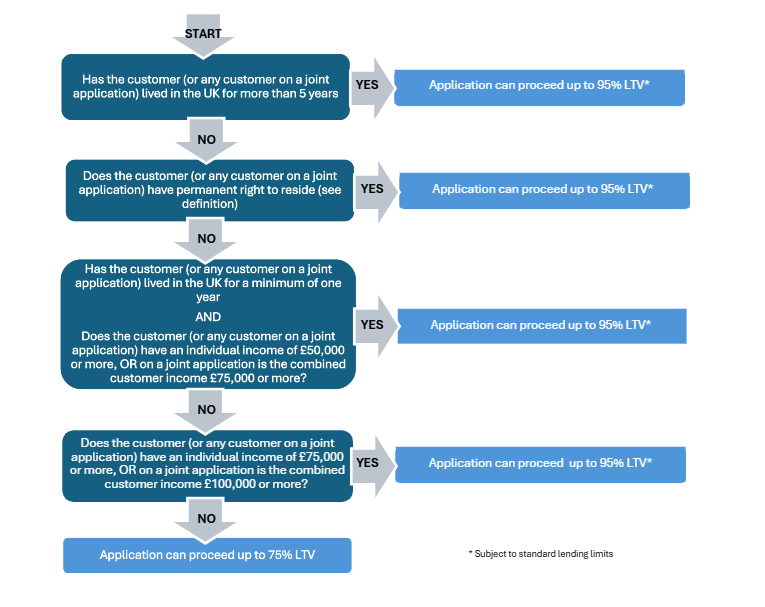

Halifax are lowering the minimum income requirement for applications that lived in the UK for a minimum of one year to £50,000 for individuals and £75,000 for joint applications.

For customers with less than one year in the UK we’ll still be able to proceed if they meet the previous minimum income requirement (individual £75,000, joint £100,000), or at a maximum 75% loan to value (LTV).

How it works:

Amanda Bryden, Head of Halifax Intermediaries & Scottish Widows Bank, said:

“The feedback we’ve received shows the market for non-UK national’s wanting to buy a permanent home has been underserved and that there is demand for a greater level of mortgage lending.

“By lowering the minimum income for non-UK applicants, we are increasing the opportunities for home ownership and for brokers to extend the products and services they offer to clients they may previously not have been able to support.”